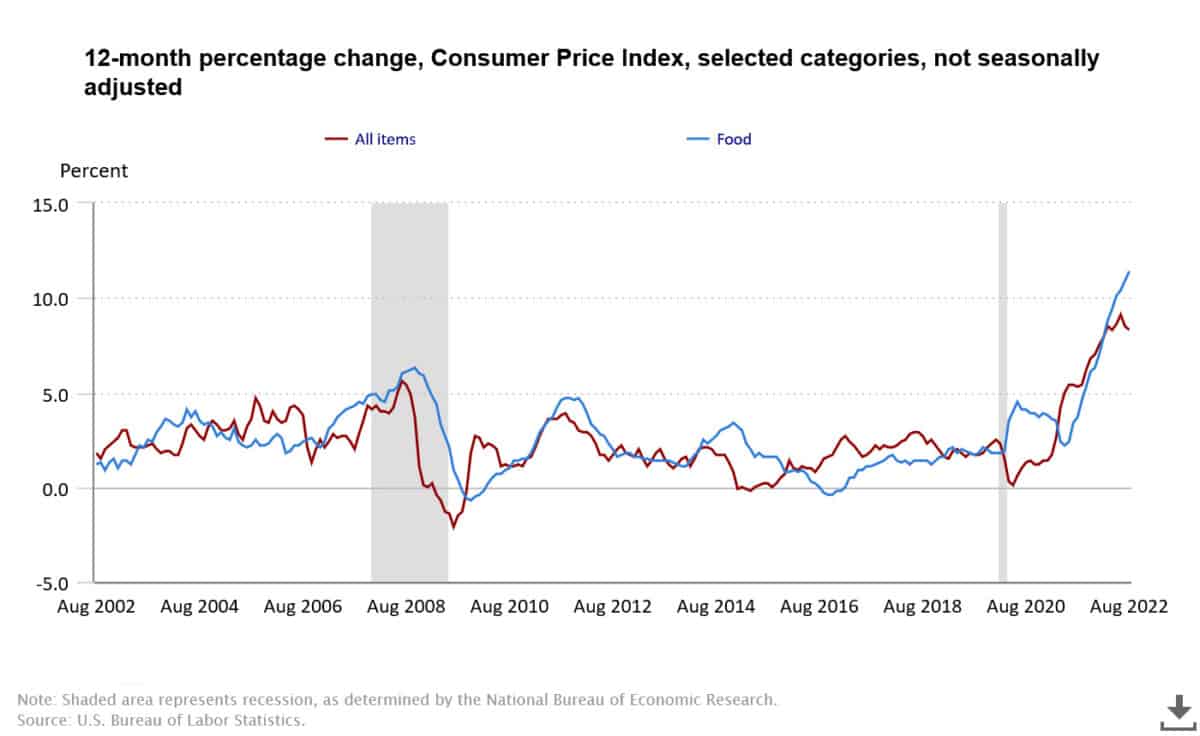

While inflation shows signs of slowing in several sectors of the economy, food and beverage prices continue to rise, forcing consumers to change their shopping habits drastically.

According to Information Resources, Inc.’s (IRI) August report, retail food and beverage inflation rose 13.4% year over year. At 1.6%, August also marked the largest price increase by category so far in 2022.

Meanwhile, the U.S. Bureau of Labor Statistics released its consumer price index report indicating that consumers paid higher prices for everything from cereal to eggs last month, pushing retail food price inflation up 0.7% in August and 13.5% on a year-over-year basis.

Separately, IRI’s report, August 2022 Price Check: Tracking Retail Food and Beverage Inflation, analyzes how inflationary pressure is driving volume declines in most categories and is hitting low-income households the hardest. In response, these families are cutting back on purchases and abandoning luxury and splurge categories. According to IRI, quick trips are also on the upswing, suggesting a shift to more deal-seeking shopper behavior.

“We are beginning to see consumers scale back purchases both in terms of units and volume in recent weeks, as retail food and beverage prices have continued to rise,” said Krishnakumar (KK) Davey, president of Thought Leadership for CPG and Retail, IRI and NPD.

“While retail food and beverage sales had been fairly resilient, we’re seeing signs of consumer stress, particularly among low-income households. Consumers are buying less in discretionary food and beverage categories and are shopping more frequently in search of better prices. At the same time, consumers are willing to pay a premium for some categories – such as pasta, pasta sauce, butter, and frozen entrées – which are considered affordable indulgences for more cash-strapped shoppers,” added Davey.

Related Article: Amid Inflation, How Are Food Retailers Aiming to Improve Customer Experience?

According to IRI’s report, August Price Check highlights include:

- Persistent inflation. Food and beverage inflation continues to persist on a year-over-year basis, despite recent price moderation in other areas of the economy, such as gasoline.

The carbonated beverage and fresh common fruit categories had the largest monthly price jump in August, each rising 5.3% compared to the end of July. Butter/margarine/spreads is the most inflated category, with prices up 30% compared to the same time last year. - Limited relief for consumers. While prices of certain food categories have begun to moderate in recent weeks, most remain elevated year-over-year. For example, prices in the coffee category rose less than 0.3% at the end of July 2022 compared to the end of June 2022 but remained over 18.6% higher in July 2022 versus July 2021.

- Consumers are responding by cutting back and indulging affordably. In response to food inflation, shoppers’ overall sales volume and units are declining quickly. Overall, retail food and beverage unit sales declined 4.5% compared to a year ago, and volume sales declined 4.0%.

The most significant drop-offs in volume are in categories where prices have risen dramatically, including frozen dinners/entrées, cookies, and coffee. However, certain snack, candy, and drink categories are more resilient, with more moderate sales volume declines despite significantly higher prices. - Consumers are bargain hunting. Trips to food and beverage stores are up 3.5% versus a year ago for the latest 12 weeks ending Aug. 21, 2022. Quick trips are up 6.7% during the same period compared to a year ago, while pantry stocking trips are down 0.6%, suggesting that consumers are looking for deals and “cherry-picking” stores where they can get the best value. And, when they stock their pantries, there is an uptick in trips to mass merchandisers and club stores, indicating value-seeking behaviors.

- Low-income households are driving the change. Low-income shoppers, who drove most of the food and beverage growth in 2021, are pulling back on food purchases as inflation increases. Volume and units of several discretionary categories – including frozen seafood, candy, and snack bars/granola bars/clusters – have slowed down significantly more in low-income stores compared to the overall market, suggesting the trade-off low-income consumers are making to feed their families.

- Premiumization continues in select categories. Despite inflation, consumers are “trading up” and driving volume share to premium brands in several categories, including snack nuts and seeds, canned and bottled fruit, frozen entrées, fresh eggs, and butter.