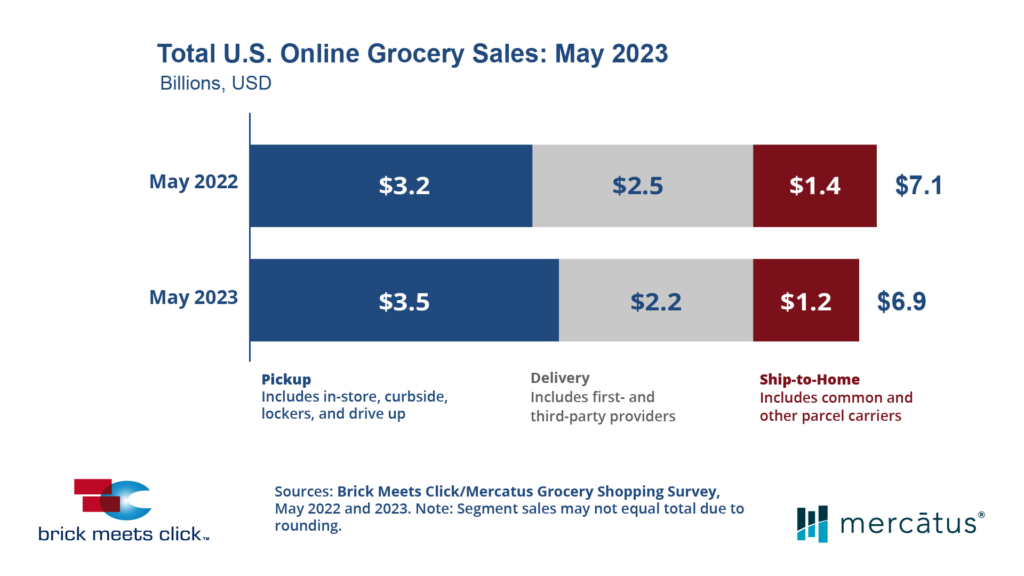

The U.S. online grocery market finished May with $6.9 billion in total sales, down 3.4% compared to last year’s $7.2 billion, according to the latest monthly Brick Meets Click/Mercatus Grocery Shopping Survey fielded May 30-31, 2023.

The dip in overall sales for May 2023 was driven by a combination of fewer households buying groceries online during the month than last year and a decline in the average number of orders placed by active shoppers.

Results were mixed across the three receiving segments.

- Pickup recorded the only year-over-year growth and captured its largest share of sales to date, climbing 9.1% and contributing 50.7% of total eGrocery sales.

- Ship-to-Home fell 17.0% versus last year and accounted for 16.8% of eGrocery sales during the month, continuing to post weaker results each year since 2020.

- Delivery declined 11.7% compared to last year, and its dollar share dropped nearly two points to 32.5% for the month.

The overall base of monthly active users (MAUs) for online grocery contracted by 5% as all three segments (Ship-to-Home, Delivery, and Pickup) experienced pullbacks in their MAU bases. In addition, the share of MAUs who used only one receiving method in May rose nearly six percentage points to 72%.

Most formats also experienced declines in their MAU bases during May, with Grocery falling nearly 2% and Mass contracting by more than 5% compared to a year ago, although the Mass MAU base remained more than 40% larger than Grocery.

Along with fewer households buying groceries online in May, the average number of orders placed by MAUs fell 5% to 2.51 versus May 2022, continuing a downward trend from the record high of 2.91 in May 2020.

“The decline in order frequency is the result of the growing number of MAUs who placed only one eGrocery order during the month. This accounted for one-third of all active customers and caused headwinds across all the segments,” said David Bishop, Partner of Brick Meets Click.

Related Article: NGA Recommends USDA Improve the WIC Online Proposal

In contrast to declines in the MAU base and order frequency, overall spending per order increased by nearly 8% in May versus the prior year, largely due to higher prices for grocery products.

Looking at each segment, Pickup’s average order value (AOV) climbed almost 13% in May to $92, and Delivery edged up 5% to $85. However, these gains were partially offset by lower AOVs in the Ship-to-Home segment, which slipped by a little more than 3% on a year-over-year basis.

Comparing formats, the combined AOV for Pickup and Delivery for Grocery grew almost 9%, and Mass increased by nearly 14% versus a year ago.

Overall repeat intent rates declined 270 basis points in May versus last year, marking the third straight month in which customers indicated a lower likelihood of using the same Pickup or Delivery service again within the next 30 days compared to the same periods in 2022.

The downward trend continued due to Grocery’s scores, which fell by 560 basis points in May, while Mass reversed course and climbed 720 basis points compared to the same period a year ago.

“Given the decreasing number of online customers and the decline in repeat intent rates, it is imperative for regional grocers to gain a deeper understanding of their customer’s evolving needs and effectively adapt,” stated Sylvain Perrier, president and CEO of Mercatus. “As customer expectations continue to rise, it is crucial for grocers to reassess their current service standards and ensure that the shopping experience aligns closely with these elevated expectations.”

Online’s share of total grocery spending dropped in May, falling 270 basis points to 12.1% versus last year. Excluding Ship-to-Home, since most conventional supermarkets don’t offer it, the adjusted contribution from Pickup and Delivery finished at 10.0%, down 190 basis points compared to a year ago, due to Delivery’s weaker performance for the month.