Most restaurant operators do not expect a rapid return to a normal business environment, according to a National Restaurant Association survey conducted February 2-10, 2021.

Six in 10 operators think it will be at least 7 months before business conditions return to normal for their restaurant. Although eating and drinking place sales rose in January for the first time in four months, monthly volume remained $11 billion – or more than 16% – below pre-coronavirus levels.

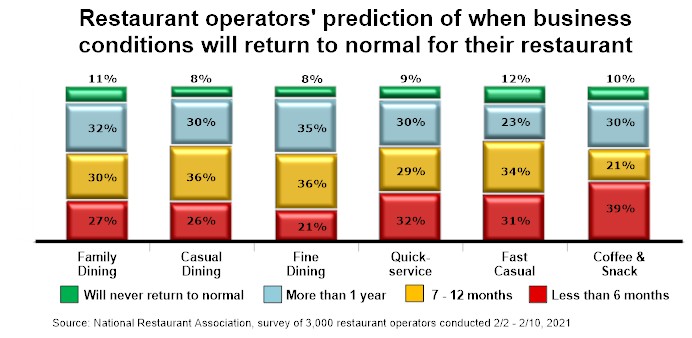

Overall, 32% of operators think it will be 7-12 months before business conditions return to normal for their restaurant, while 29% believe it will be more than a year. An additional 10% of operators say business conditions will never return to normal for their restaurant.

It’s important to note that returning to normal business conditions does not necessarily mean a full recovery to pre-coronavirus sales levels, said the Association. Instead, it reflects an operational environment that doesn’t include indoor dining restrictions and a vaccinated populace that feels confident going out to public places.

January’s sales gain was a step in the right direction, according to Bruce Grindy, the Association’s chief economist, but the industry’s road to recovery remains long.

On the segment level, fine dining operators envision the most prolonged timeline to a typical operating environment. Seventy-one percent of fine-dining operators think it will be at least 7 months before business conditions return to normal for their restaurant. Eight percent don’t think it will ever happen.

Related Article: Sysco Eliminates Minimum Delivery Requirements

While the time horizon is somewhat shorter for limited-service operators, it still won’t happen overnight. Only 3 in 10 quick-service and fast-casual operators – and 39% of coffee and snack concept operators – think business conditions will return to normal within the next 6 months.

After trending sharply lower at the end of 2020, restaurant sales bounced back with a healthy gain in January. According to preliminary data from the U.S. Census Bureau, eating and drinking places registered sales of $54.6 billion on a seasonally-adjusted basis in January. That was up 6.9% from December’s sales volume of $51.1 billion and represented the largest monthly increase since June.

Winter Doesn’t Help restaurant Operators

However, it wasn’t enough to make up for the 8.3% drop in sales during the final three months of 2020. And restaurants lost a vital customer touchpoint during the recent surge in winter weather, with outdoor dining becoming less feasible in many parts of the country.

Outdoor dining had been a lifeline for many restaurants, particularly in areas that ramped up indoor dining restrictions in recent months, said the Association.

Only 42% of full-service operators say their restaurant currently offers on-premises outdoor dining in a space such as a patio, deck, or sidewalk, according to a National Restaurant Association survey conducted February 2-10, 2021. That’s down from 52% in November and 74% in September.

In the limited-service segment (quick-service, fast-casual, and coffee/snack concepts), 37% of operators say they currently offer outdoor dining – down from 46% in November and 60% in September.