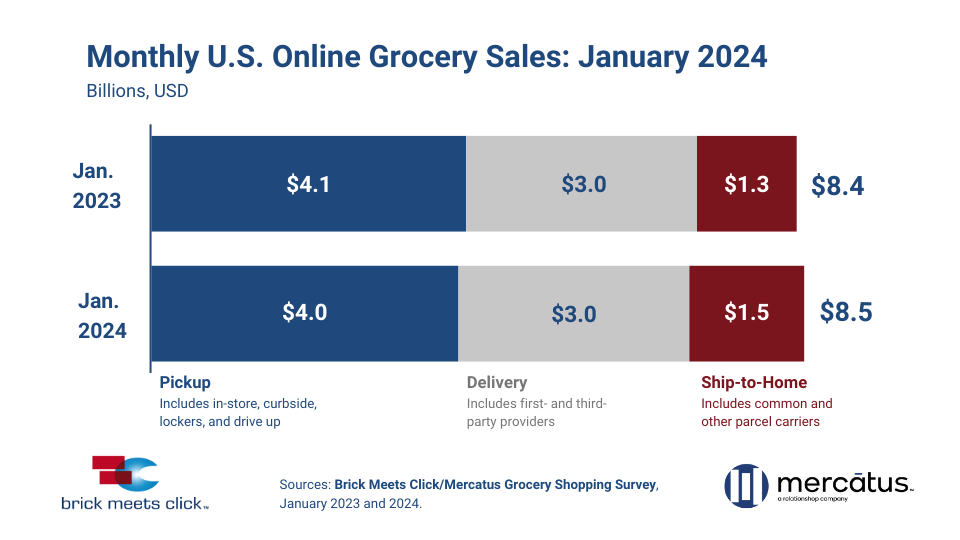

The U.S. online grocery market finished January with total sales of $8.5 billion, up 1.8% compared to 2023, according to the most recent monthly Brick Meets Click/Mercatus Grocery Shopper Survey fielded January 30-31, 2024.

Despite a jump in the total number of households buying groceries online during the month, January’s overall sales growth was moderated year-over-year by a downward trend in order frequency and a composite average order value (AOV) nearly flat compared to the prior year.

Monthly results varied by the receiving method and format as Mass continued to expand share while Supermarkets contracted.

Ship-to-Home was the only segment to grow year-over-year as sales climbed to $1.5 billion in January, up 7.8% compared to a year ago. Higher order volume, driven by a surge in monthly active users (MAUs) and a more than 7% increase in AOV, helped the segment capture 224 additional basis points (bps) to end the month with 17.4% of total online grocery sales.

Related Article: Trends in Supermarket Operations in 2024

January’s delivery sales of $3.0 billion slipped slightly, down 0.5% versus 2023, as the 3% growth in its AOV could not offset the more significant decline in order volume.

While the Delivery MAU base expanded slightly, the gain was eclipsed by the decline in order frequency among MAUs. As a result, Delivery’s share of online grocery sales slipped 82 bps to 35.3% for the month.

Pickup remained in the top spot, but its sales fell 1.9% to $4.0 billion for January, mainly due to lower order frequency by MAUs and a 1.8% contraction in AOV, despite a moderate expansion of its MAU base.

Pickup finished the month with 47.3% of eGrocery sales, down 142 bps versus January 2023.

Mass Continued to Expand Share while Supermarkets Contracted

“When more than 10% of U.S. households have less money to spend on groceries this year than they did last year, changes in buying behavior are certainly expected,” said David Bishop, partner at Brick Meets Click. “The reduction in SNAP payments that took effect at the end of February 2023 is one of the factors driving the flight-to-value trend, which we’ve observed and tracked since mid-2023.”

The Mass format, led by Walmart, outperformed the broader market. In total, Mass expanded its MAU base by almost 10% while it also posted a healthy uptick in AOVs, and the growth in its MAU base more than compensated for flat year-over-year order frequency among its active customers.

In contrast, Supermarkets endured ongoing headwinds as key performance indicators (KPIs) all struggled compared to last year. The number of Supermarket MAUs contracted by more than 5%, the average number of orders completed by MAUs during the month fell at a larger rate, and the average dollars spent per order pulled back slightly.

Amazon’s pure-play online services, which account for the largest share of the Ship-to-Home segment, also saw performance improvements compared to the prior year, but those improvements need to be put into context.

Given the significant MAU drop Amazon experienced in January 2023, this January’s MAU surge was driven partially by more accessible comparable results.

Overall, Amazon’s year-over-year MAU gains more than offset the drop in order frequency; moderate AOV gains also helped drive its positive sales results.

Online Grocery Cross-Shopping Between Grocery and Mass Dips Slightly

Cross-shopping between Mass and Grocery (including Supermarket and Hard Discount) decreased slightly in January compared to the prior year. Although Walmart’s rate climbed over 300 bps versus a year ago, the overall dip resulted from a decline in cross-shopping among other Mass retailers.

Last month, more than 29% of households that bought groceries online from Grocery also purchased groceries online using a Mass retailer’s shopping service.

Overall, cross-shopping rates between Grocery and Mass remain nearly twice as high as before the onset of the pandemic.

The composite repeat intent rate for online grocery Pickup and Delivery in January jumped 430 bps versus 2023 to 63.8%, suggesting that more MAUs will likely use the same service again within the next 30 days.

Mass expanded its edge over Grocery by 30 bps on this metric as the format drove more substantial customer scores with both Delivery and Pickup.

“Competing online is only getting more challenging for regional grocers as customer expectations continue to increase,” said Mark Fairhurst, Global Chief Growth Officer at Mercatus. “So, beyond improving key elements of the experience, like fill rates, wait times, and product quality, regional grocers also need to work even harder to identify additional ways to help their customers save money.”

Online grocery sales across all formats accounted for 13.4% of total weekly grocery spending during the last week of January, increasing 120 bps compared to the previous year.

The combined contribution of Pickup and Delivery, since most conventional supermarkets do not offer Ship-to-Home, also grew 72 bps to finish the month at 11.1%